We have help our customers address every Payroll challenge confronting them. we understand the complexities of payroll thoroughly and have helped businesses of all sizes handle them. NECRON ensures accuracy and reliability.

We have help our customers address every Payroll challenge confronting them. we understand the complexities of payroll thoroughly and have helped businesses of all sizes handle them. NECRON ensures accuracy and reliability.

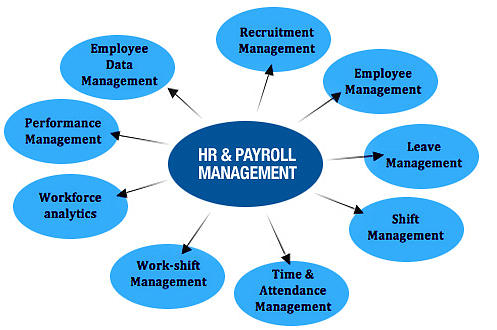

We are committed to provide each Client Organisation and its employee a comprehensive and all encompassing service covering the following areas :

- Employee Data Management

- Payroll Processing

- Employee Benefit Management

- Employee Retiral Administration

- HR MIS & Analytics

- Statutory Registration & Compliance

- Labour Law Compliance

Employee Data Management

Employee Data Management

- Employee Communication Template

- Customizing the letter for employee

- Maintain employee life cycle data

Payroll Processing

- Employee Master Updation

- Company Specific Reporting

- Inputs Updation

Employee Benefit Management

- Attendance & Leave Record Maintenance

- Handling Employees Queries

- Investment Planning & Proof Checking

- ESI Management

- Reimbursement Management

- Employee Self Service

- Full and Final Settlement

Labour Law Compliance

- Payment of Gratuity Act

- Payment of Bonus Act

- Payment of Wages Act

- Minimum Wags Act

- Maternity Benefit Act

- Equal Remuneration Act

- The Karnataka Shops & Commercial Establishments Act

- Contract Labour (Regulation & Abolition) Act

- The Karnataka Industrial Employment (Standing Orders) Rules

- Karnataka Labour Welfare Fund Act

HR MIS & Analytics

- Attendance & Leave Management

- Employer Portal

Statutory Registration & Compliance

- Provident fund

- Gratuity Fund Formation

- Income Tax – IT Returns & Form 16

- Profession Tax

- ESI

- Labour Laws

- Superannuation Fund Formation

- Remittance & Returns

- Audit & Inspection

- Shops & Establishment

- Factories Act

- TAN & PAN

Employee Retiral Administration

- Provident Fund – RPFC

- Audit & Inspections

- Exempted Provident Fund Trust Management & Accounts

- Superannuation Fund Trust Management & Accounts

- Gratuity Fund Trust Management & Account

We will do the comprehensive and systematic review of the Company Policies and the effective implementation of the same. A detailed study into the various compliances relating to statutes of Provident Fund, Employee State Insurance, Profession Tax, Income Tax and Labour/Factories Act.

- Complying with different regulations

- Company policies are in line with the Statutes

- Identification of gaps or lapses and their regulation

- Proper maintenance of files/records

Complying with different regulations

- The Audit team will study the documents relating to the aspects of monthly remittances and preparation and filing of monthly/quarterly/half yearly and annual returns

Company policies are in line with the Statutes:

- The Audit team will study the company policies with relevance to the various laws and regulations.The laws covered will be –

- Profession Tax

- Income Tax

- Employees Provident Fund Act(EPF)

- Employee State Insurance (ESI)

- Karnataka Shops & Commercial Establishment Act

- Factories Act

Identification of gaps or lapses and their regulation

- Suggestions to comply with the nonconformities

- Detailed report on the gaps found during the Audit.

Proper maintenance of files/records

- Documents relating to the assessment/scrutiny/notices by the Department

- Ensure the availability of original remittance challans

- Ensure the availability of acknowledgement copies of returns

- Review of files and records

- Display of Abstracts and Notices